Fundraising is an essential aspect of running a successful nonprofit organization. Without adequate funding, a nonprofit can hardly sustain its operations or achieve its mission. Smart nonprofit owners strive to...

Apply in minutes

Apply in minutes No obligations

No obligations Line costs nothing until used

Line costs nothing until usedNo costs to set up or keep in place. Payoff Line whenever you are ready.

Reputable company with A+ & 5-STAR rating. Much Easier and Faster than a bank line of credit or bank loan.

An unsecured business line of credit. Inexpensive to use. Helps manage small business cash flow.

Specializing in small businesses, nonprofits, churches, and FedEx ISPs. Proud provider of minority and women-owned business lines of credit.

The fastest setup in the industry, 48-72 hours. Line requests wired to your bank in minutes. Secured account portal access 24 x 7.

No collateral, personal guarantee, or restrictions required. Credit line renews yearly & easily.

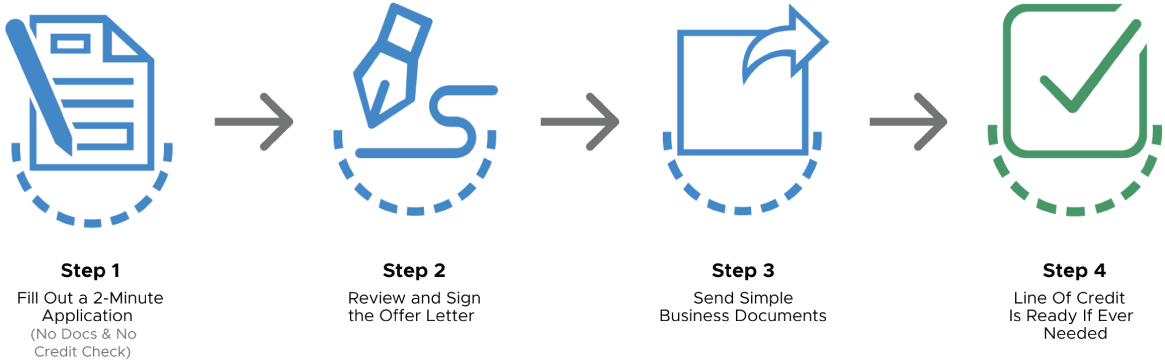

4 Easy Steps to having a great small business line of credit. A line of credit… just in case

Financing Solutions began operations in 2012. Since then, it has grown to be one of the top direct financing companies in the U.S., providing small business lines of credit and nonprofit lines of credit that are easy, fast, and inexpensive. We require no collateral or personal guarantees. We pride ourselves on our 5-star reviews and an A+ rating from the Better Business Bureau/Google Reviews.

Having built businesses ourselves, we are not from the traditional banking or Wall Street crowd. We know how hard it is to be approved for a traditional bank loan. Financing Solutions is a leading provider of lines of credit to nonprofits, small businesses, churches, and Fedex ISPs in the United States.

We have an “A+” rating from the Better Business Bureau, and our reviews are 5 stars on Google reviews. Unlike our competitors, when you reach out to us, you will talk to real people. Our small business line of credit is easy to access at any time.

With no paperwork to fill out, we can quickly give you a good idea if you will be approved for a business line of credit. If you want to move forward, the remaining process is fast & easy, only requiring a few simple-to-get, business cash flow documents.

We approve many businesses, nonprofits, churches, and FedEx ISPs who thought they would never be able to get a business line of credit because we look at your organization from many angles.

People often have many questions about small business lines of credit. Check out the answers to the five most frequently asked.