When running a small business, sometimes you run into a brick wall. Trying to get a bankline at a commercial bank can be one of those barriers. That’s why smart business owners are now finding other options.

Every business needs quick business financing at some point. If you are currently facing a cash shortage, you need help immediately. The answer may lie in getting a bankline. Unfortunately, a commercial bank is no longer the first place you should turn for assistance.

What is a Bankline

A bankline or line of credit, offers a way to control your finances. The bank or lender agrees to provide you with a certain amount of business capital. These funds sit in your account until you need them.

If you are experiencing a cash flow shortage or other emergency, you can borrow from the account. Unlike a typical business bank loan, the money can be used for any business purpose.

You only repay what you actually use from the account. If it is a revolving line of credit, the funds become available again after you pay the money back. With banklines that are not revolving, once you repay the money, the account is closed.

Who Offers a Bankline Other Than Commercial Banks?

Traditional banks have practically stopped being a friend to small business. They have strict rules about collateral and credit score that most entrepreneurs simply can’t meet. As a result, more than 50 percent of fast business funding applications at a bank are denied.

Fortunately, there are now several alternative lenders you can turn to. The most favorable option is a business cash advance company, like Financing Solutions (www.financingsolutionsnow.com).

Existing businesses can turn to Financing Solutions for a business line of credit up to $150,000. They make it easy to apply and you can get a line in place within 48 hours.

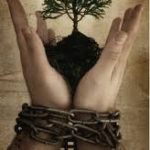

How to Turn Business Obstacles into Opportunities

As a small business owner, you know that you can’t let obstacles stop you. You must find ways to go over, around or through them.

For example, bad luck can happen at any time. It could be equipment malfunction, weather emergencies or the loss of a key employee or client. However, you can turn this into an advantage, and it all depends on how you react. Adopt a new attitude and become the problem solver. Develop a crisis strategy; create new hiring policies and network with others in your industry. See challenges as new chances to grow and make your business better.

Also, always have a plan B (or C or D, etc). The world of business is becoming more and more unpredictable. Don’t get so accustomed to operating the same way all the time that you can’t see a way out when the unexpected occurs. When you focus on the goal instead of the plan, you can always find ways to adjust to any situation.

The best way to turn things around is with instant business funding from Financing Solutions. This is the ideal solution to keep your business moving forward.