Managing Temporary Cash Flow Gaps

Nonprofit organizations can experience timing differences between when expenses must be paid and when funding is received. In certain situations, access to short-term financing can help bridge temporary gaps without disrupting operations.

When used responsibly and with a clear repayment plan, a line of credit can support cash flow needs during funding delays. It is generally most effective as a short-term tool rather than a long-term funding solution.

Alternatives to Informal Borrowing Arrangements

Some nonprofits rely on informal borrowing arrangements, such as loans from board members or donors, to address short-term cash needs. While these approaches may work occasionally, they can introduce governance, compliance, and relationship challenges if used repeatedly.

More structured financing options can provide clearer terms, defined repayment expectations, and appropriate oversight, helping organizations avoid complications associated with informal borrowing.

Payroll Timing and Cash Flow Responsibilities

Meeting payroll obligations is a critical responsibility for nonprofit organizations. Miss or delay payroll, and you could be fined by your state. Plus, your employees depend on their paycheck. Timing gaps between incoming funds and payroll schedules can create pressure if not planned for in advance.

Establishing a clear cash-flow strategy can help organizations meet payroll and other essential obligations during funding delays, while maintaining compliance and financial stability.

Our Review and Decision-Making Approach

Financing Solutions works with nonprofit organizations to evaluate financing decisions responsibly. Our review process considers an organization’s financial profile, cash-flow consistency, and existing financial controls.

This approach emphasizes informed decision-making rather than automated approvals, helping nonprofit leaders assess whether financing aligns with their organization’s needs and risk tolerance.

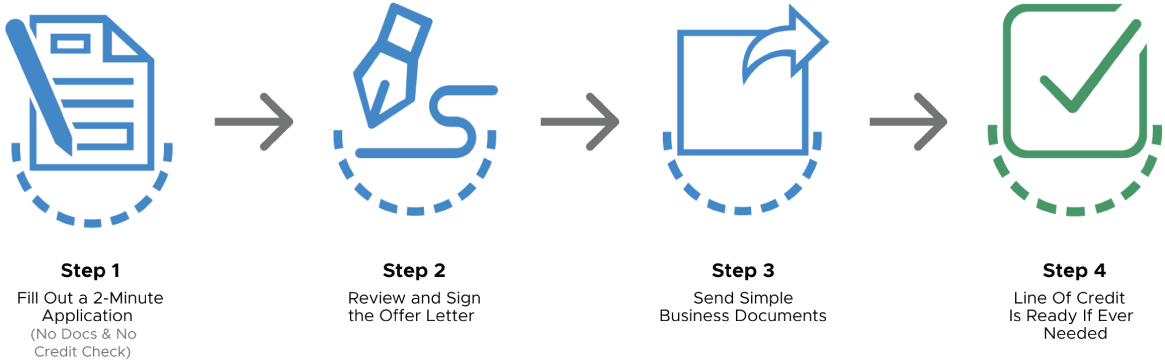

What to Expect During the Application Process

An unsecured nonprofit line of credit may be appropriate in certain situations, depending on an organization’s financial profile and cash-flow consistency.

Unlike secured financing, unsecured credit does not rely on specific collateral, which may be appealing for some nonprofits

Unsecured credit requires careful evaluation of repayment ability and existing financial controls

Understanding the tradeoffs involved can help nonprofit leaders determine whether this type of financing aligns with their organization’s needs and risk tolerance