No costs to set up or keep in place. Payoff Line whenever you are ready

Reputable company with A+ & 5-STAR rating. Much Easier and Faster than a bank line of credit or bank loan

An unsecured line of credit. Inexpensive to use, helps manage small business cash flow

Proud provider of minority and women-owned business lines of credit

The fastest setup, 48-72 hours. Line requests are wired to your bank in minutes. Secured account portal access 24 x 7

No collateral, personal guarantee or restrictions required. Credit line renews yearly & easily

Every business has ups and downs in cash flow. We have the best business line of credit because our credit line costs ZERO to setup, ZERO when not being used and is inexpensive when needed. Why not get it in place now just in case you need it.

Most online lenders make decisions by computer algorithms. We do not. The owners of Financing Solutions have built several businesses themselves and are involved in every approval. You can, and probably will, speak to one of our owners.

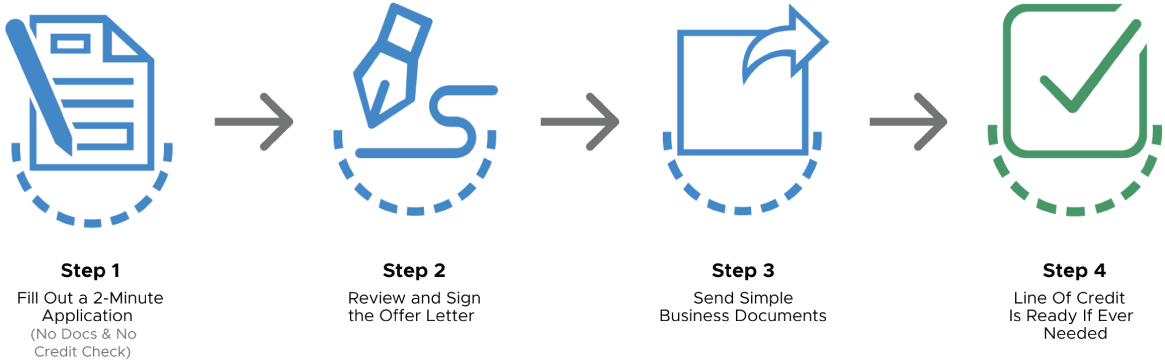

Business owners are busy people, we made the process simple. Fill out our 2-minute online application, Review and sign offer letter, Send in simple documents like a Tax return and bank statements. And your business line of credit is there when needed.

4 Easy Steps to having a great small business line of credit.

A line of credit… just in case

Financing Solutions began operations in 2012 and has since grown to be one of the top direct financing companies in the U.S. providing small business lines of credit and nonprofit lines of credit that are easy, fast, and inexpensive. We require no collateral or personal guarantees. We are very proud of our 5-star reviews and an A+ rating from the Better Business Bureau/Google Reviews.

We are not from the traditional banking or wall street crowd having built business ourselves. We know how hard it is to be approved for a traditional bank loan. We are a leading provider of lines of credit to nonprofits, small businesses, churches, and Fedex ISP‘s in the United States.

We have an “A+” rating from the Better Business Bureau and our reviews are 5 stars on Google reviews. Unlike our competitors, there are real people you will talk to. Our small business line of credit is easy to access at any time.

With no paperwork to fill out, we can give you a good idea if you will be approved for a business line of credit. If you want to move forward, the remaining process is fast & easy only requiring a few, simple-to-get, business cash flow documents.

We approve many businesses, nonprofits, churches, and Fedex ISP’s who thought they would never be able to get a business line of credit because we look at your organization from many angles.