A small business line of credit is a short-term revolving line of credit used for operating expenses such as covering bills, payroll, or unexpected needs. A business line of credit...

Fast Small Business Line of Credit Application… Apply Today, Receive an Offer Today!

Costs zero to set up and Zero when not used. Inexpensive when needed.

Every Business Should Have a Line of Credit… Just in Case

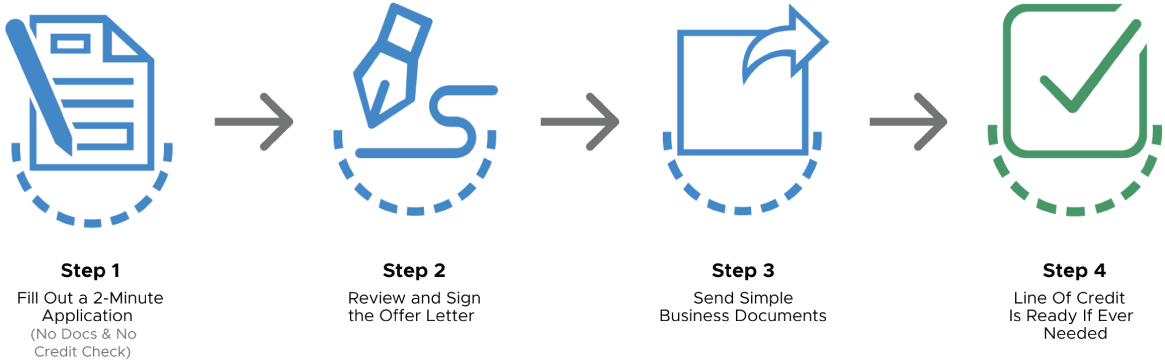

4 Easy Steps to having a great small business line of credit.

A line of credit… just in case

Why do thousands of small business owners work with Financing Solutions? Because we understand small businesses and we provide direct business funding. We also understand the business financing landscape, including business lines of credit from commercial banks, small business loans from other business lenders, and even the government SBA business loan process. We look at many parts of your business, so we can say “YES” to a fast business line of credit where others would say “NO”…And we don’t waste your time.

At Financing Solutions, we believe that every business needs a line of credit. Why? Because for many years, our founders have been small business owners, just like you, and we saw the benefit of having a business line of credit.

No costs to set up or keep in place. Payoff unsecured business credit line whenever you are ready.

Reputable company with A+ & 5-STAR rating. Much easier and faster than a bank line of credit or bank business loan.

An unsecured small business line of credit. Inexpensive to use, helps manage small business cash flow.

Proud provider of minority and women-owned business lines of credit.

The fastest setup in the industry, 48-72 hours. Line requests are wired to your bank in minutes. Secured account portal access 24 x 7.

No collateral, personal guarantee, or restrictions required. Credit line renews yearly & easily.

Every business has ups and downs in cash flow. We have the best business line of credit because our credit line costs ZERO to set up, ZERO when not being used, and VERY LITTLE when needed. Why not get it in place now, just in case you need it?

Most online lenders make decisions by computer algorithms. We don't. The owners of Financing Solutions have built several businesses themselves and are involved in every approval. You can, and probably will, speak to one of our owners.

Business owners are busy people. We made the process simple. All you have to do is fill out our 2-minute online application, review and sign an offer letter, and send in simple documents like a Tax return and bank statements. And your business line of credit is there when needed.

Financing Solutions began operations in 2012. Since then, it has grown to be one of the top direct financing companies in the U.S., providing small business lines of credit and nonprofit lines of credit that are easy, fast, and inexpensive. We require no collateral or personal guarantees. We pride ourselves on our 5-star reviews and an A+ rating from the Better Business Bureau/Google Reviews.

Having built businesses ourselves, we are not from the traditional banking or Wall Street crowd. We know how hard it is to be approved for a traditional bank loan. Financing Solutions is a leading provider of lines of credit to nonprofits, small businesses, churches, and Fedex ISPs in the United States.

We have an “A+” rating from the Better Business Bureau, and our reviews are 5 stars on Google reviews. Unlike our competitors, when you reach out to us, you will talk to real people. Our small business line of credit is easy to access at any time.

With no paperwork to fill out, we can quickly give you a good idea if you will be approved for a business line of credit. If you want to move forward, the remaining process is fast & easy, only requiring a few simple-to-get, business cash flow documents.

We approve many businesses, nonprofits, churches, and FedEx ISPs who thought they would never be able to get a business line of credit because we look at your organization from many angles.

People often have many questions about small business lines of credit. Check out the answers to five frequently asked