Immediate Press Release Financing Solutions Reveals Small Nonprofits Credit Line Utilization Up a Whopping 70% Leading Line of Credit Provider Says Small Nonprofits Are Utilizing Their Nonprofit Line Of Credit...

Apply Today. Same Day Answer. Yes, we provide lines of credit to Nonprofits.

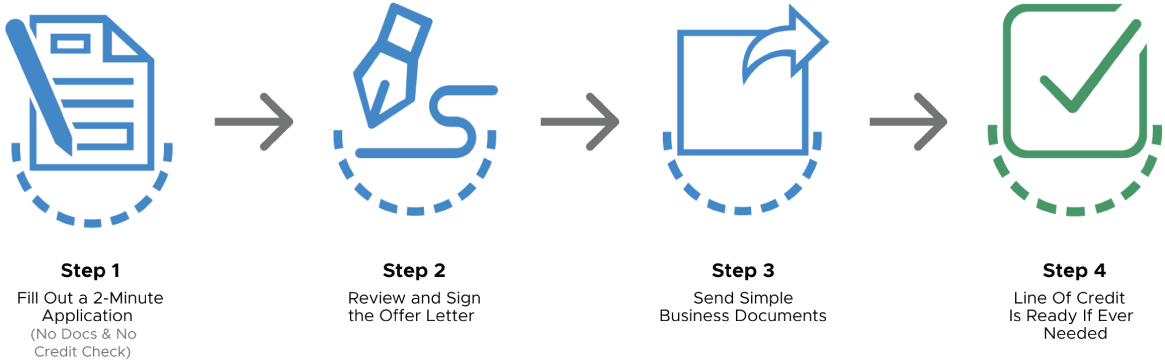

4 Easy Steps to having a great Nonprofit line of credit.

Why do thousands of small nonprofits organizations work with Financing Solutions? Because Financing Solutions is the leading provider of nonprofit financing in the United States to small nonprofits, and we are a direct funder. We know how hard it has been in the past to get bank loans for nonprofits. We look at many parts of your nonprofit organization, so we can say “YES” to an unsecured nonprofit line of credit where others would say “NO”…And we don’t waste your time. At Financing Solutions, we believe that every nonprofit organization needs a nonprofit credit line, and now it is easier than ever to have one.

No costs to set up or keep in place. Payoff Line whenever you are ready.

Reputable company with A+ & 5-STAR rating. Much Easier and Faster than a bank line of credit or bank loan.

An unsecured line of credit. Inexpensive to use. Helps manage Nonprofit cash flow.

Leading provider in the U.S. of small nonprofit financing, credit lines, and alternatives to nonprofit mortgages.

The fastest setup in the industry, 48-72 hours. Line requests wired to your bank in minutes. Secured account portal access 24 x 7.

No collateral, personal guarantee, or restrictions required. Credit line renews yearly & easily.

Every nonprofit has ups and downs in cash flow. Our credit line costs ZERO to set up, ZERO when not being used, and is VERY LITTLE when needed. Many nonprofit organizations will get the line of credit in place now, just in case it is needed down the road.

Every Nonprofit Executive Director will tell you that borrowing money from a board member or donor is OK the first time, but asking for it repeatedly can cause friction. Plus, there are serious IRS ramifications if it isn’t done properly.

Most nonprofit executives are unaware that delaying paying your staff is not only illegal and results in serious fines, but it also causes concerns in your employees. A nonprofit line of credit helps you make payroll and you can pay it back when funds come in.

We don’t make decisions with computer algorithms. The owners of Financing Solutions are involved in every deal, and you will often speak to one of them. That’s good because we really know nonprofits and are straight shooters. Plus, we are flexible if you run into financial issues.

We know very well that Executive Directors are busy people. So, we made the process as simple as possible. Fill out the 2-minute online application. Review and sign an offer letter. Send in simple documents like a recent 990 and bank statements. Sign final contract. Get Board Approval. And your Nonprofit line of credit is ready when needed.

Financing Solutions began operations in 2012 and has since grown to be one of the top direct financing companies in the U.S. providing small business lines of credit and nonprofit lines of credit that are easy, fast, and inexpensive. We require no collateral or personal guarantees. We are very proud of our 5-star reviews and an A+ rating from the Better Business Bureau/Google Reviews.

We are not from the traditional banking or wall street crowd having built business ourselves. We know how hard it is to be approved for a traditional bank loan. We are a leading provider of lines of credit to nonprofits, small businesses, churches, and Fedex ISP‘s in the United States.

We have an “A+” rating from the Better Business Bureau and our reviews are 5 stars on Google reviews. Unlike our competitors, there are real people you will talk to. Our small business line of credit is easy to access at any time.

With no paperwork to fill out, we can give you a good idea if you will be approved for a business line of credit. If you want to move forward, the remaining process is fast & easy only requiring a few, simple-to-get, business cash flow documents.

We approve many businesses, nonprofits, churches and Fedex ISP’s who thought they would never be able to get a business line of credit because we look at your organization from many angles.

People often have many questions about Nonprofit lines of credit.

Check out the answers to five frequently asked