In business, there are many times when you have to turn a negative situation into a positive one or change confusion to clarity. However, when you need to know where to turn for a financing loan, the direction is not always so clear.

The ability to qualify for a financing loan could one day help to save your business. Therefore, it is vital that you know where you can go to get one.

How Can You Get a Financing Loan for Your Business?

It is an incorrect perception that banks loan money to help build a business. Banks will only loan money if the business owner puts up assets. This could include your house, building, or a portion of accounts receivables.

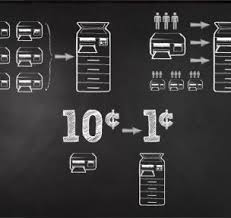

Traditional factors can provide a financing loan for your business, but at a very high price. They typically charge expensive fees, sometimes thousands of dollars, which gets added to the cost of your loan.

Additionally, they lock you into long term repayment schedules for up to two years. Worst of all, some have policies which force you to change your normal way of doing business, such as insisting that your creditors write checks to them, instead of your business.

Are There Alternatives to a Financing Loan?

Trying to get quick business financing can feel like walking through a maze while blindfolded. Every way you turn leads to dead ends and obstacles.

A cash advance company, like Financing Solutions (www.fundmypayroll.com), can give you a way out. They will give you fast cash to get your finances back on the right path.

With Financing Solutions, you won’t experience the same strict criteria that you face at a traditional bank. They are willing to look at your business as a whole, such as how long you have been paying your bills on time and your future earnings potential. Therefore, even if you don’t have exceptional credit, you can be approved.

Also, they have a quick and easy processes and terms. It only takes a 15 minute phone interview to get started so you won’t be bogged down with tons of paperwork. Best of all, there is no long term commitment. Their convenient repayment schedule allows you to pay the money back in a few short weeks or months without penalty.

Ways to Better Manage Your Finances

As a small business owner, it can sometimes be difficult to manage your finances. There are account receivables coming in and orders going out constantly and it can be hard to keep up with it all. However, as the most important aspect of your business, it is crucial to manage it properly.

Sometimes, a great accountant and the right computer programs can make all the difference. For example, you may be able to improve your cash flow by using software that allows you to process payments immediately when purchases are made with mobile devices.

Perhaps the best way to manage your finances is to find an alternative lender that understands your situation, like Payroll Financing Solutions. They know how challenging it can be to run a business and will be there to help you by providing fast business funding when you need it most.